Home/ Blog / How to Strengthen Your Regulatory Change Management Process in 2025

Regulatory change in 2025 is no longer linear or predictable. Sudden policy shifts are accelerating in volume, shifting direction across agencies, and becoming increasingly difficult to interpret. Executive orders, rule reversals, and state-level actions necessitate a proactive regulatory change management process, often without consistent guidance or clear timelines. For financial institutions, this means rising regulatory uncertainty, tighter response windows, and greater risk of misalignment.

Manual approaches to tracking, interpreting, and responding to these changes aren’t enough. Compliance teams need real-time tools that can monitor regulatory activity, interpret its impact, and help coordinate a timely response.

This blog examines the regulatory challenges faced by financial organizations and how generative AI in banking solutions can transform the management of regulatory change. From consolidating intelligence to mapping changes to policies and controls, this technology brings much-needed clarity, speed, and structure. With the right solution, organizations can move from reactive updates to proactive compliance, keeping pace with change while reducing complexity and risk.

The Challenges in a Deregulated Environment

This year, deregulation has been introduced as a new kind of complexity. Executive actions are reversing existing rules, pausing enforcement, and introducing abrupt shifts in regulatory priorities. Instead of reducing the compliance burden, these changes often result in conflicting guidance and unclear expectations. Agencies may repeal regulations without issuing replacement standards, leaving business institutions in a state of uncertainty.

Compounding the challenge, states are filling perceived gaps with their own rules, particularly in areas such as data privacy, AI governance, and environmental policy. The result is a fragmented regulatory environment where federal and state priorities often diverge.

Organizations still relying on traditional, manual regulatory change management processes will struggle to keep up. Static spreadsheets and scattered tracking systems fail to deliver the speed or accuracy needed to manage real-time changes. As the volume of updates increases and ambiguity grows within the financial sector, compliance teams face a higher risk of oversight gaps, misinterpretation, and delays in action, making it harder to ensure alignment across departments and regulators.

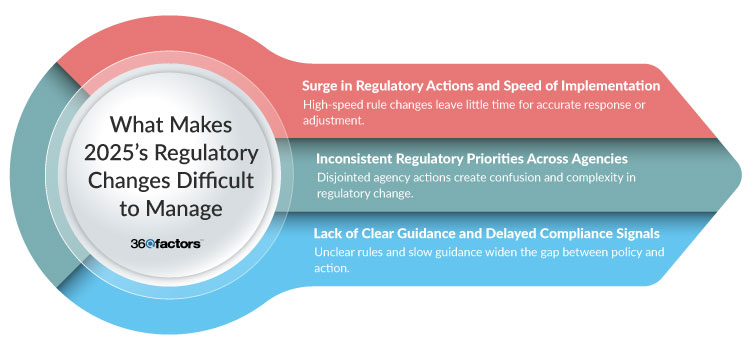

What Makes 2025’s Regulatory Changes So Challenging

1. Unprecedented Volume and Pace of Change

The start of 2025 marked a surge in executive and regulatory activity. Within the first 100 days of the new administration, over 140 executive actions were issued, and more than 60 existing rules were repealed or revised. This intensity of activity, described in a KPMG report as an “unprecedented level of activity,” has left financial institutions struggling to keep up.

The challenge lies not just in the volume of changes but in the speed at which they are introduced. New orders were issued in rapid succession, often without detailed guidance or phased implementation timelines. Compliance teams must quickly determine which regulations will remain in effect, which policies require updates, and how internal systems and processes should be adjusted. With limited time to assess impact, the risk of missing critical updates or misinterpreting new obligations increases.

This rapidly evolving landscape requires robust regulatory change management processes that surpass traditional tracking methods. Financial institutions need dynamic systems that consolidate updates, interpret relevance, and support real-time decision-making.

2. Conflicting Direction Across Agencies

Regulatory divergence is another significant source of complexity. While one agency may be scaling back a rule, another may be pursuing stricter enforcement or rewriting its scope entirely. This lack of coordination among federal regulators is creating conflicting expectations across the board.

For example, banking regulators are moving away from Basel III capital rules, relaxing specific standards around liquidity and capital adequacy. Meanwhile, FinCEN is narrowing the enforcement of the Corporate Transparency Act, limiting its application to foreign entities only. These redirections reflect broader shifts in agency priorities, but they create headaches for compliance leaders who must keep their institutions aligned with all applicable rules.

Such inconsistencies make it difficult to develop unified regulatory change management processes. Teams must continuously reassess their understanding of agency intent, adjust controls based on incomplete information, and manage cross-departmental coordination. The margin for error shrinks as the regulatory map becomes less cohesive.

3. Delayed Policy Impact Assessment and Compliance Response

Even when regulations are rolled back or enforcement is paused, clarity about how to proceed is often lacking. The gap between policy changes and practical guidance has widened in 2025, forcing institutions to navigate transitions without a clear path forward.

As federal priorities shift, many states are stepping in, introducing legislation in areas such as AI safety, consumer data protection, and environmental oversight. This dual-track approach has created overlapping and sometimes contradictory expectations. Institutions now face the challenging task of deciding whether to follow relaxed federal standards or adhere to more stringent state requirements.

Delays in regulatory policy guidance or enforcement clarification make compliance response timelines harder to manage. Without certainty on when or how to adapt internal policies, organizations risk falling out of alignment. This internal misalignment can trigger issues during audits or exams, mainly when expectations differ across jurisdictions.

In this environment, the regulatory change management process is becoming an operational and legal challenge. It will be imperative to track, interpret, and act on change with speed and precision.

Modernize Regulatory Change Management with Predict360 RCM Software

The complexity and pace of regulatory change in 2025 demand more than manual tracking and fragmented workflows. Predict360 Regulatory Change Management Software provides a modern solution designed to help financial institutions manage these challenges efficiently. By consolidating regulatory changes from multiple sources into a single platform, the software ensures that teams stay current without the burden of chasing information.

AI-powered parsing can pinpoint relevant changes and deliver a preliminary impact assessment, showing which business units and internal documents will be affected. This can save time and improve accuracy when adjusting controls, policies, or procedures in response to evolving regulations.

Kaia – AI Companion for Regulatory Intelligence

Kaia, Predict360’s AI companion for regulatory intelligence, enhances decision-making by answering regulatory queries in natural language, interpreting new rules based on your organization’s policies, and linking changes directly to impacted documents.

When regulatory direction is unclear or enforcement is delayed, Kaia helps reduce uncertainty by quickly identifying the most relevant information. Integrated into the Predict360 RCM Software, it delivers a connected, AI-powered approach to regulatory change management, one that enables faster decisions, stronger alignment, and more consistent compliance in a dynamic and often fragmented environment.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.