Home/ Blog / Navigating Uncertainty with an AI-Driven Regulatory Change Management Process

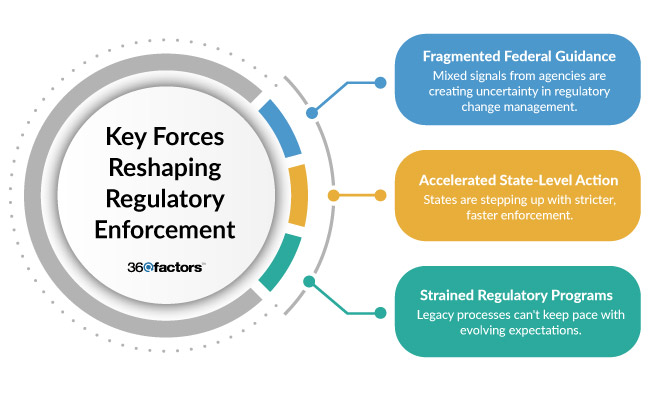

Regulatory enforcement has become increasingly fragmented and inconsistent, presenting new challenges for financial institutions. Rather than operating under a uniform set of expectations, organizations now face conflicting directives, delayed guidance from federal agencies, and a widening gap between federal de-prioritization and heightened enforcement at the state level. This evolving landscape has introduced legal uncertainty and operational complexity for the regulatory change management function.

Key federal entities have reduced emphasis on certain regulatory risks and have signaled shifts in their enforcement posture. Concurrently, state authorities have intensified their focus on issues such as consumer protection, cybersecurity, and AI governance, stepping in to address perceived gaps in federal oversight. The result is a regulatory environment that is less predictable and more difficult to navigate.

For compliance leaders, this shift raises critical operational questions:

- Who is responsible for enforcement?

- When does the regulation take effect?

- What internal actions are required for a timely and appropriate response?

These challenges cannot be addressed through static policies or outdated workflows. In the absence of consistent regulatory clarity, institutions must adopt proactive, adaptive strategies. These should be grounded in continuous monitoring, strong internal governance, and technology-enabled intelligence, such as the use of generative AI in banking, which enables change to be traceable, accountable, and actionable.

Three Drivers Behind the Regulatory Enforcement Shift

1. Arbitrary Federal Legislation Creates Legal Ambiguity

Federal regulators are sending mixed signals about what risks matter and how seriously they should be treated. As per the KPMG report,”First 100 Days: Where (De?)Regulation Goes from Here,” several notable investigations, including cases involving the Foreign Corrupt Practices Act (FCPA) and cryptocurrency enforcement, have been paused or dropped midstream. This inconsistent follow-through has introduced legal ambiguity, making it harder for institutions to assess their enforcement exposure.

Recent policy changes reinforce the uncertainty that impacts the regulatory change management procedures:

- The Office of the Comptroller of the Currency (OCC) removed “reputation risk” from its list of supervisory focus areas, signaling a shift away from perception-based enforcement.

- A Department of Justice (DOJ) memo discouraged the use of enforcement as a regulatory tool, ending what it called “regulation by prosecution.”

- Federal actions are now being selectively reevaluated in favor of national interest, adding more unpredictability to enforcement timelines and priorities.

Compliance teams are left navigating delayed or unclear guidance, relying more heavily on internal interpretation and legal judgment to stay aligned. This growing uncertainty increases the risk of inconsistent practices and raises the stakes for institutions trying to maintain credible regulatory change management solutions without clear direction.

2. States Are Now Setting the Regulatory Agenda

As federal enforcement activity slows, states are stepping in with greater urgency. They are addressing perceived gaps in regulatory change management by taking more localized and focused action. Across the country, State Attorneys General (AGs) are expanding their enforcement authority in high-impact areas like:

- AI safety and algorithm oversight

- Consumer financial protection

- Cybersecurity and data privacy

In 2025 alone, six new AGs have taken office, and three former AGs now serve as state governors. These leadership changes reflect a broader trend: enforcement is becoming a top priority for both politics and law at the state level.

States are acting in areas such as consumer financial protection, AI systems safety and privacy, fair labor practices, cybersecurity & data privacy, and securities fraud. The result is a patchwork of state laws and expectations that can vary widely across jurisdictions, increasing complexity for institutions that operate across multiple regions.

Institutions relying only on federal updates risk being caught off guard. State-led enforcement can be stricter, faster-moving, and more closely tied to emerging technologies or politically sensitive concerns.

3. Regulatory Risk Programs Under Pressure Amid Shifting Expectations

Regulatory change management programs are facing growing pressure to keep pace with evolving rules, shifting priorities, and rising expectations. With inconsistent guidance across jurisdictions, traditional compliance methods, such as static policy reviews or annual assessments, are no longer sufficient.

To remain effective, institutions must:

- Monitor regulatory changes in real time

- Empower staff with ethical and legal training

- Maintain internal consistency, even when external standards shift

Siloed teams interpreting rules differently pose a serious audit risk, especially when policies haven’t been updated to reflect the latest developments. Compliance professionals must address these gaps quickly to avoid exposure, not just in areas currently under scrutiny, but also in those temporarily deprioritized at the federal level.

A proactive approach grounded in self-governance, real-time visibility, and ethical clarity is now essential to maintaining a credible compliance posture.

How AI-Powered Regulatory Change Management Process Helps Financial Leaders

1. Unified Visibility Across Jurisdictions

One of the most pressing challenges for regulatory change management teams is keeping pace with developments across both federal and state levels. An AI-enabled platform delivers a single source of truth, consolidating updates from regulatory agencies into a centralized database. Instead of relying on scattered inboxes, internal email chains, or department-specific trackers, institutions gain a unified view of relevant changes. This real-time visibility reduces missed updates and ensures that regulatory shifts, regardless of source, are never overlooked.

2. AI-Based Mapping of Regulatory Impact and Ownership

Generative AI in banking is playing a crucial role in helping institutions understand how new regulations impact their internal operations. Intelligent mapping tools can analyze regulatory content and automatically identify the policies, procedures, systems, and business units that are affected. From there, ownership is clearly defined; tasks are assigned, responsibilities tracked, and status updates captured within a shared environment. This reduces interpretation errors and brings greater accountability for change execution.

3. Real-Time Execution and Documentation

With regulatory expectations evolving faster than ever, institutions must document compliance efforts as they happen. AI-driven regulatory change management tools enable coordinated task management, centralized evidence tracking, and real-time activity logs, facilitating seamless workflow management. Even when agency guidance is delayed or ambiguous, financial institutions can demonstrate readiness through complete, audit-friendly records. The result is a more agile and responsive compliance program, built to withstand today’s regulatory volatility.

Implement Predict360 Regulatory Change Management Software to Stay Compliant

As enforcement priorities shift suddenly and regulatory expectations become less predictable, financial institutions must modernize their approach to managing change. Navigating today’s fragmented landscape requires more than awareness; it demands real-time insights, structured execution, and tools that transform uncertainty into coordinated action. That’s where Predict360 Regulatory Change Management Software delivers incredible value.

The platform unifies the entire change management process. It collects regulatory updates from trusted sources into a centralized feed, utilizes intelligent parsing to flag key information, and performs automated impact assessments to identify affected risks, controls, and business units. With built-in task tracking and stakeholder notifications, compliance teams can take timely action, monitor progress, and maintain audit-ready documentation from a single location.

Supporting this platform is Kaia, Predict360’s AI-powered companion designed to bring clarity and speed to complex compliance workflows. It answers natural-language questions about new rules, summarizes regulatory documents, and highlights which risks and controls may require updates. It reduces manual research, improves response accuracy, and accelerates every step of the regulatory change management process.

Request a Demo

Complete the form below and our business team will be in touch to schedule a product demo.

By clicking ‘SUBMIT’ you agree to our Privacy Policy.